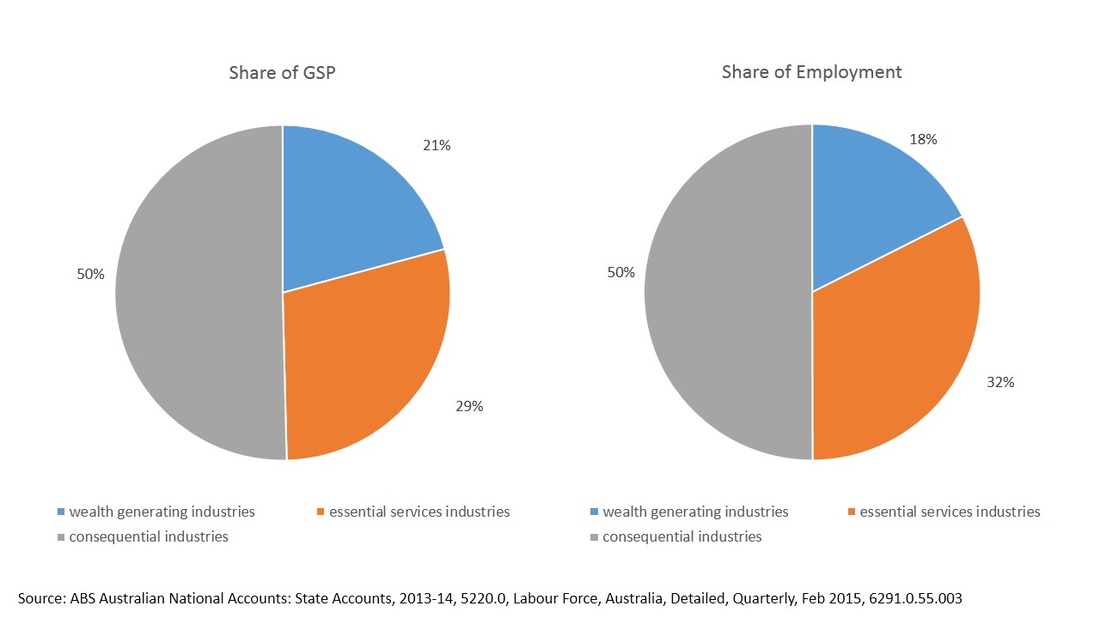

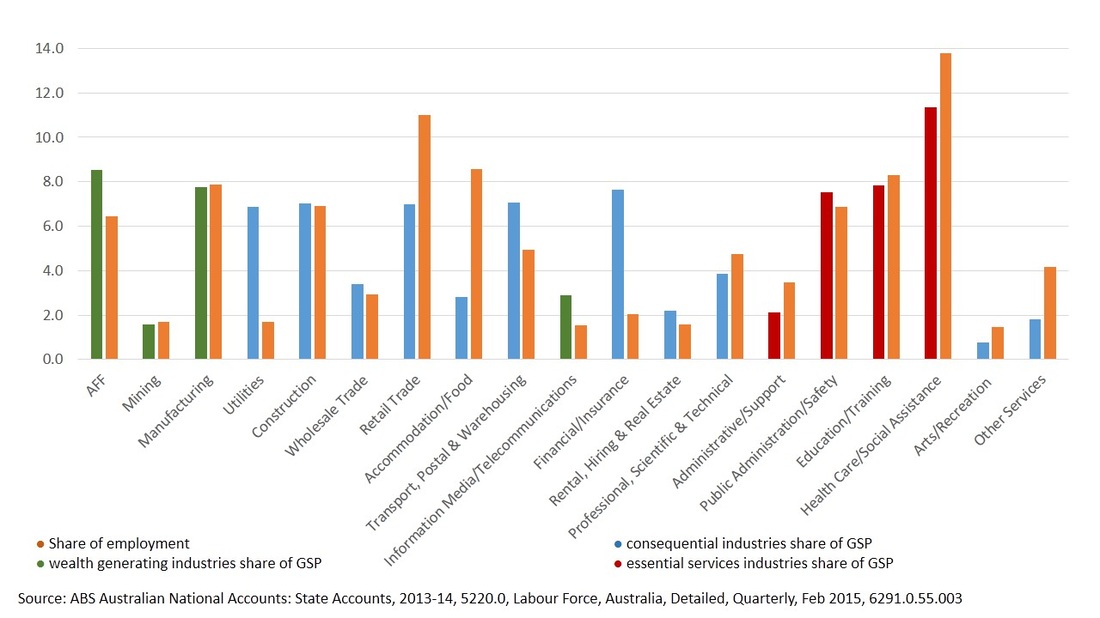

Industry sectors can be classified as either wealth generating, essential services or consequential industry sectors.

Wealth generating industries are those in the private sector which are predominantly trade based sectors. Wealth generating industries are positive net contributors of tax receipt revenue through both sectoral core business activity and associated taxes and through the employment of tax payers.

Essential services industries are those sectors which are largely funded by public money to provide essential services to the population.

Consequential industries are those sectors reliant on the availability of discretionary income (the amount of an individual's (and households) after tax income available for spending after the essentials have been taken care of )[1]. Discretionary income comes in the form of the employed population, tourists, international students and financially independent individuals; increasingly self-funded retirees in an ageing population. Consequential industries are also dependent on the business confidence of wealth generating industries, and to a lesser degree, essential services industries, in the form of both investment and employment decisions.

The ability to provide essential services to a population is dependent on government revenue collected through tax receipts. and of course, Commonwealth distributions.

Each ANZSIC sector is classified into wealth generating, essential services and consequential industries in the table attached below. The Electricity, Gas, Water and Waste Services industry sector is an interesting one to classify given it is dominated by GBEs, however, given its dependence on wealth generating industries consumption and households, it is classified as a consequential industry.

| wce_industries.pdf |

Increased investment and employment in wealth generating sectors will result in an increase in the Marginal Propensity to Consume (MPC) of individual and households.

When MPC increases, consumption in consequential sectors is likely to increase, increasing employment, as such, tax receipts will increase correspondingly and likely result increased government expenditure in the form of infrastructure spending and employment in the essential services sectors. When MPC decreases (in times of economic downturn), consumption in consequential sectors decreases and job losses occur (unless demand is stimulated by external sources e.g. tourists, international students, financially independent people etc). Furthermore, the ability to provide essential services is compromised in times of economic downturn.

If Tasmania is to enjoy long term, sustainable employment growth into the future, then job creation needs to focus on the wealth generating industry sectors. To grow these sectors, attention needs to be provided to improving and increasing the 3Cs - competitiveness, capability and capacity as I have outlined in a previous blog and presentation - Tasmania's productivity profile.